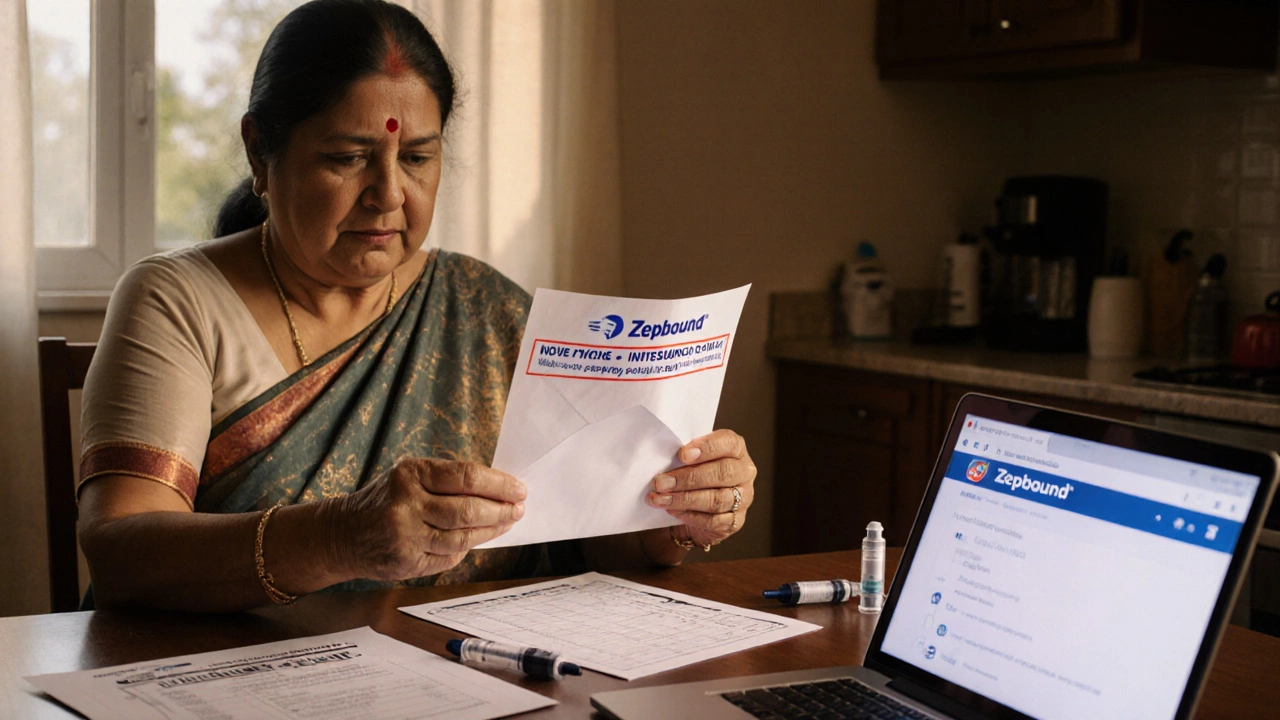

Zepbound Insurance: What It Covers and How to Get It in India

When you hear Zepbound, a prescription weight loss medication containing tirzepatide, approved for adults with obesity or overweight with weight-related conditions. Also known as Mounjaro, it's the same drug used for type 2 diabetes but now prescribed at higher doses specifically for weight loss. Unlike older drugs like Ozempic, Zepbound works on two hormones—GLP-1 and GIP—to reduce appetite and slow digestion. But here’s the real question: Zepbound insurance coverage in India? It’s complicated.

Most private health insurance plans in India don’t cover weight loss drugs unless they’re tied to a diagnosed medical condition like type 2 diabetes or severe obesity with complications. Zepbound isn’t yet on the standard formulary for most insurers. Even when it is, prior authorization is almost always required. You’ll need lab results, BMI records, and proof you’ve tried diet and exercise first. Some corporate health plans or premium international insurance policies might include it, but out-of-pocket costs can run ₹40,000–₹70,000 per month. That’s why many people look at alternatives like metformin, which is widely covered, or lifestyle programs that are actually reimbursed by insurers.

Related to this are GLP-1 agonists, a class of drugs that mimic the body’s natural hormone to control blood sugar and appetite. Also known as semaglutide, this group includes Ozempic, Wegovy, and now Zepbound. These drugs are changing how we treat obesity, but they’re not magic pills. They work best when paired with real changes in eating habits and movement. That’s why doctors in India are starting to recommend them only after patients have tried structured programs—something most insurance plans still prefer over expensive medications.

If you’re considering Zepbound, check your policy’s list of covered medicines. Call your insurer directly—don’t rely on websites or your doctor’s word alone. Ask: Is tirzepatide covered? Is prior authorization needed? Are there step therapy rules? Some clinics offer payment plans or patient assistance programs, but these vary by region. And remember: even if insurance doesn’t cover it, the long-term health benefits—lower risk of heart disease, diabetes, joint pain—might make it worth the cost.

What you’ll find below are real, practical articles that connect to this issue: how weight loss drugs like Zepbound compare to other treatments, what insurance actually pays for in India, and how to navigate the system when your doctor recommends something expensive. You’ll also see what alternatives work, what side effects to watch for, and how to talk to your insurer without getting lost in jargon. This isn’t about hype—it’s about knowing your options when your health is on the line.

Why Won’t Insurance Cover Zepbound? Understanding Denials and How to Get Approved

Learn why insurance often denies Zepbound, the top reasons for rejection, and step‑by‑step tactics to win approval and lower costs.