Insurance Denial: Why Your Medical Claim Got Rejected and What to Do Next

When you get an insurance denial, a formal refusal by a health insurer to pay for a medical service or treatment. Also known as a claim rejection, it happens when the insurer says your procedure, test, or medication isn’t covered under your policy. This isn’t just a paperwork hiccup—it’s a real barrier to care, especially in India where out-of-pocket medical costs can crush families. Many people assume denial means the treatment isn’t needed, but often it’s about fine print, coding errors, or missing paperwork—not medical logic.

Common reasons for insurance denial, a formal refusal by a health insurer to pay for a medical service or treatment. Also known as claim rejection, it happens when the insurer says your procedure, test, or medication isn’t covered under your policy. include: the service isn’t listed as covered, the provider is out-of-network, the diagnosis code doesn’t match the procedure, or the insurer claims it’s "not medically necessary." In India, pre-authorization delays and lack of clarity from insurers make this worse. You might have paid for a policy thinking it covers everything, only to find out your hospitalization for a heart procedure was denied because the insurer says it’s "elective"—even though your doctor called it urgent.

What’s worse is that many people give up after the first denial. But you have rights. Under Indian insurance regulations, insurers must give you a written reason for rejection. You can appeal. You can ask your hospital’s billing team to refile with corrected codes. You can request a peer review if the insurer says a treatment isn’t necessary. And if you’re insured through an employer, your HR department should help you navigate this. A health insurance claim, a formal request submitted to an insurer for payment of medical expenses. Also known as medical claim, it’s your legal right to get covered care when you’ve paid premiums. isn’t a favor—it’s a contract.

The posts below cover real cases where people faced insurance denial after major procedures—from heart surgery to IVF—and how they fought back. You’ll find guides on what to say when calling your insurer, how to decode your policy’s fine print, and which tests or treatments are most commonly denied in India. Some posts even show how people got approvals after being turned down twice. This isn’t theory. It’s what worked for others in your exact situation.

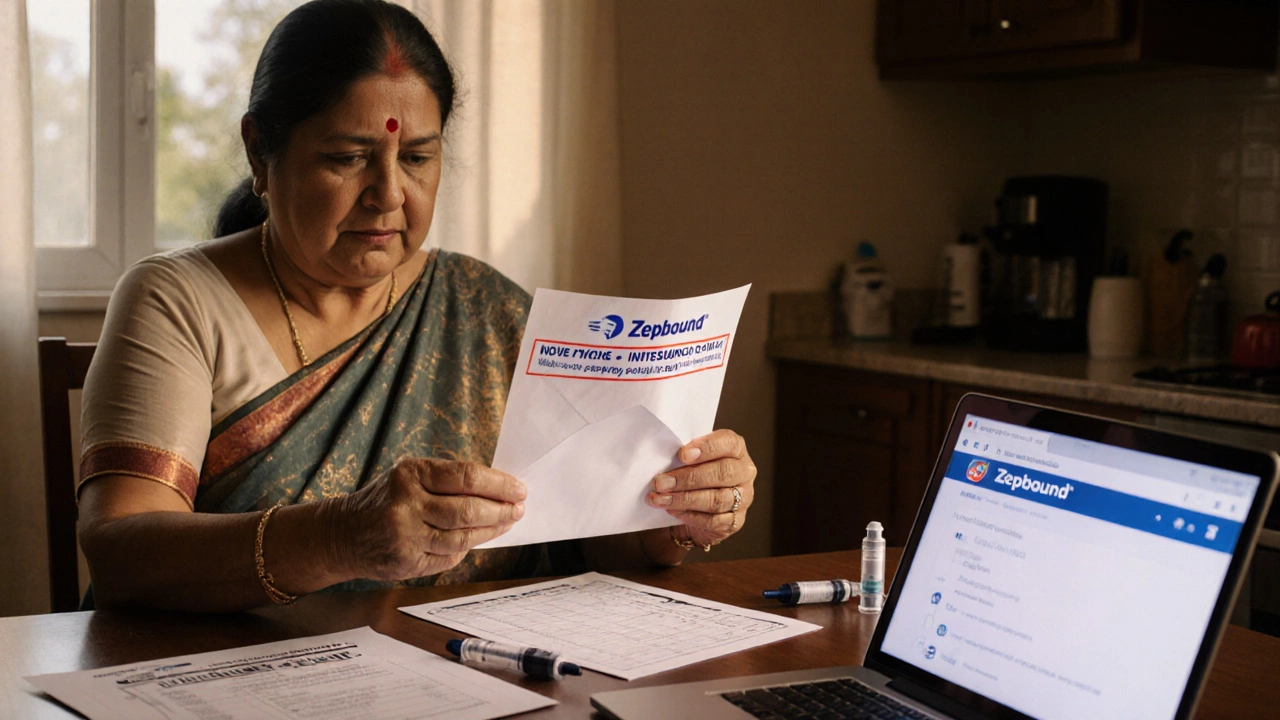

Why Won’t Insurance Cover Zepbound? Understanding Denials and How to Get Approved

Learn why insurance often denies Zepbound, the top reasons for rejection, and step‑by‑step tactics to win approval and lower costs.