If you’re getting ready for an international trip, it’s tempting to toss your Medicare card into your wallet with everything else—just in case. But here’s the kicker: Original Medicare usually does not pay for health care you get outside the U.S. and its territories. That tiny red, white, and blue card feels like a security blanket, but once you land in Paris or Tokyo, it’s practically useless for local hospitals and clinics.

This throws a lot of folks off. The habit is to clutch that Medicare card, thinking it’ll cover you anywhere. That’s not how it works, though. You’ll want to know what coverage you really have, what options fill the gaps, and what paperwork (if any) actually makes sense for travel. Relying on your Medicare card abroad is about as good as flashing your library card at airport security—they’re going to shrug and ask for something more relevant.

- Why Medicare Doesn’t Cover You Everywhere

- When (and Where) Your Medicare Card Matters Abroad

- What Happens If You Need Medical Attention Overseas

- Smart Alternatives: Supplements, Insurance, and Paperwork

- Real-World Stories and Common Mistakes

- What You Should Actually Pack for Medical Safety

Why Medicare Doesn’t Cover You Everywhere

Most folks are a little surprised when they first learn this: Medicare coverage isn’t worldwide. The reason is pretty straightforward—Medicare is a U.S. government program, funded by American taxpayers, and it’s designed to pay for care strictly inside the United States and its territories. So, as soon as you hop off that plane in another country, regular Medicare is no longer your safety net.

There are a few rare exceptions, but they’re extremely specific. For instance, Medicare might pay if you’re in the U.S., but a foreign hospital is actually closer in an emergency (think being near the Canadian or Mexican border). Or if you’re traveling a direct route between Alaska and another U.S. state, and you have a real medical emergency in Canada—then you might squeeze in under a technicality. That’s about it.

To keep things clear, here’s what Medicare covers abroad:

- If you’re in the U.S. when a medical emergency happens and a foreign hospital is closer than the nearest U.S. hospital.

- If you’re traveling through Canada "without unreasonable delay" between Alaska and another state and have a medical emergency.

- If you live in the U.S., but a foreign hospital is closer for either emergency or non-emergency care.

Here’s the reality check: those scenarios are rare. For most travelers, traditional Medicare offers zero help once you cross U.S. borders except for those slim exceptions. Even Medicare Advantage plans might offer limited coverage, but it varies plan by plan and country by country.

Take a look at this quick snapshot:

| Location | Original Medicare Coverage |

|---|---|

| U.S. & territories | Yes |

| Europe | No |

| Asia | No |

| Canada (transit/rare emergency) | Only in rare emergency situations |

So if you’re counting on your Medicare card as your medical passport overseas, you’re set up for a rude awakening if you get sick. It’s way better to know the rules before your trip than be scrambling in a foreign ER.

When (and Where) Your Medicare Card Matters Abroad

It might surprise you, but flashing your Medicare card on most foreign trips won’t do anything for you. Original Medicare only covers you in the U.S. and its territories—that’s it. The handful of exceptions are so specific most travelers never hit them by accident.

Here’s exactly where your Medicare card might get you coverage outside the mainland U.S.:

- If you’re in the U.S. when you have a medical emergency and the closest hospital able to treat you is in Canada or Mexico, you’re covered—but only for that emergency, and just enough to get you stabilized.

- If you’re traveling between Alaska and another state by the most direct route, and have an emergency that means stopping in Canada for care, Medicare may pay for covered services at a Canadian hospital.

- Live on a cruise ship? If you’re within 6 hours of a U.S. port, you might get coverage if there’s a doctor on board who’s authorized to bill Medicare.

Notice a trend? These are all edge-cases—niche situations that probably won’t line up with your travel plans, unless you’re driven up the Alaska Highway or spending a lot of time on cruise ships hugging the American coast.

| Location | Medicare Coverage? | Details |

|---|---|---|

| France, Germany, Japan | No | Medicare won’t pay for services. |

| Canadian/Mexican hospital near U.S. border | Sometimes | Only for U.S. residents with an emergency if closest hospital is across the border. |

| Cruise ship within 6 hours of U.S. port | Sometimes | Doctors must be authorized by Medicare. |

For basically any other scenario—vacationing, studying, or living for months at a time abroad—don’t count on your Medicare card. Local healthcare systems won’t recognize it, and any paperwork you bring won’t change their minds. If you’re still holding out hope your Medicare card will save the day outside the U.S., it’s time to look at other safety nets.

What Happens If You Need Medical Attention Overseas

Let’s say you’re hiking in Costa Rica or dining in Italy and something goes wrong medically—what now? Here’s where the reality of Medicare card limitations really hits. Most U.S. Medicare plans just don’t pay for doctor visits or hospital stays outside the country. If you flash that Medicare card at the ER desk in Madrid, you’ll probably get a polite smile and a bill. In most places, you’re seen as a cash-paying tourist until proven otherwise.

If you end up needing care, you’ll usually be asked to pay up front—sometimes before treatment even starts. Clinics are used to seeing tourists in a jam, and they’ll want proof of payment or private travel insurance. Depending on the country, costs could be anywhere from totally affordable to shockingly high, especially if you wind up in a private hospital.

Now, if you have Medigap Plans C, D, F, G, M, or N, or a Medicare Advantage plan with some overseas coverage, you might get reimbursed for emergencies abroad—but you still pay first and claim later. Save everything: receipts, doctor’s notes, prescriptions, and even copies of your passport stamps if you can.

- Always find out if there’s an English-speaking clinic nearby before you travel.

- Look up emergency numbers (they’re not 911 everywhere!).

- Ask your hotel or host for guidance on the most reliable local hospitals.

Here's a quick look at how some places differ for U.S. visitors seeking medical help:

| Country | Typical Payment Needed Upfront | English-Speaking Staff? |

|---|---|---|

| France | Yes | Often, but not guaranteed |

| Mexico | Yes | Varies by location |

| Australia | Yes, unless you have travel insurance | More common in large cities |

| Thailand | Absolutely yes | Good in major hospitals |

Bottom line: Your Medicare card won’t save you from the unexpected bills. Plan like you’ll be on your own for costs, and make sure you have a backup strategy. Even a quick doctor’s visit abroad can turn into a paperwork headache if you’re not ready for it.

Smart Alternatives: Supplements, Insurance, and Paperwork

Your plain ol' Medicare card won’t get you far overseas, but that doesn’t mean you have to risk your health (or your savings) when traveling. Let’s run through the smart moves to actually protect yourself medically—and financially—when you’re outside the country.

The first thing to look into is Medicare Supplement plans, often called Medigap. A few of these, like Plan G, Plan N, or the grandfathered Plan F, include a little bit of emergency coverage abroad. Here’s the thing: even those Medigap options will only reimburse you for emergencies in the first 60 days of travel, and usually cap lifetime benefits at $50,000. Plus, you have to pay a $250 deductible first, then they only handle 80% of the approved costs. That isn’t bad, but it’s definitely not full coverage.

If you have Medicare Advantage (Part C), read the fine print. Some plans toss in limited emergency coverage abroad, but it varies a lot by provider. Never assume you’re covered—ask your plan or check their travel policy in detail.

The real secret weapon for international trips is travel medical insurance. This is a separate policy designed for emergencies outside the US. Unlike Medigap or Advantage, these plans are custom-fitted for trips abroad. They often include things like emergency evacuation and translation assistance. Plus, coverage can be way more generous than what you’d get from any standard Medicare add-on. According to the U.S. Travel Insurance Association, around 10% of American travelers end up needing help from their travel insurance—mostly for medical issues.

| Coverage Option | Applies Abroad? | Typical Coverage | Max Limit |

|---|---|---|---|

| Original Medicare | No | None | 0 |

| Medigap (Select Plans) | Yes (Limited) | Emergencies only, 80% after deductible | $50,000 (lifetime) |

| Medicare Advantage | Sometimes | Emergencies (varies by plan) | Varies |

| Travel Medical Insurance | Yes | Emergencies, evacuations, more | $50,000 to $1 million+ |

Alright—let’s talk paperwork. You don’t need to haul your Medicare card around, but there’s other stuff you really should carry:

- A hard copy of your travel insurance card, plus any claim instructions.

- A one-pager with your key medical info: medications, allergies, and your home doctor’s contact.

- Emergency contacts—sometimes hospitals ask right away.

- Proof of your Medicare coverage for when you get back home, in case you need follow-ups stateside.

One more tip: take photos of all these documents and store them on your phone, secured with a password. If your stuff goes missing, you’ll still have what you need.

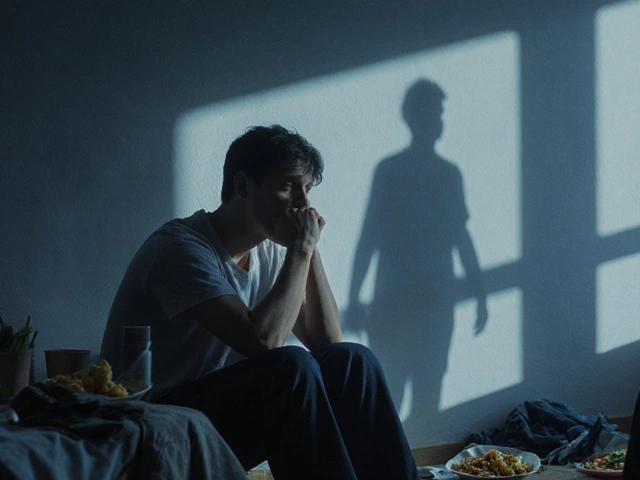

Stressing about paperwork is normal before big trips, but a little planning saves you from big headaches overseas.

Real-World Stories and Common Mistakes

I’ve run into so many travelers who thought their Medicare card was their golden ticket abroad. I remember chatting with a guy at an airport lounge who had a medical emergency in Spain. He pulled out his Medicare card at the clinic, hoping it would take care of the bill. The receptionist just shook her head. He ended up paying $2,300 out of pocket—no reimbursement, and his primary insurance line back home had zero advice for him.

Another friend of mine, Linda from Miami, learned the hard way. She landed in Thailand, caught food poisoning, and went to the ER. Her Medicare card did nothing for her there. Had she bought even basic travel health insurance, she could have saved around $1,800 in hospital fees and medication.

What if you think, “But I have a Medigap plan!” This helps sometimes: certain Medigap policies like Plan G, N, or F will cover you for emergencies abroad, but you have to pay a deductible first, and coverage is capped at $50,000 over your lifetime.

| Mistake | Result |

|---|---|

| Carried only a Medicare card | Denied coverage at foreign clinics |

| No travel insurance | High out-of-pocket bills |

| Didn’t check credit card perks | Missed possible help from credit card benefit |

| Didn’t save local emergency numbers | Wasted time finding help |

The most common mistake? Assuming you’re covered just because you’ve got that card in your wallet. The second is not looking into travel insurance and expecting to figure it out on the fly. Even if you’re a regular traveler, take time to double-check your options before you head out.

One smart traveler I met, Cheryl, copies all her important documents—including her Medicare card, passport, and travel insurance—and leaves digital copies with her adult son back home. When her luggage got stolen in Italy, she just called her son, and he emailed her the documents instantly. Saved her a ton of hassle during a stressful moment.

Bottom line: Overestimating your Medicare benefits overseas is a headache waiting to happen. Always look for a safety net before you go. Nobody wants to drain their travel fund on hospital bills just for skipping the research.

What You Should Actually Pack for Medical Safety

So, if your Medicare card isn’t enough for international travel, what do you really need for medical safety on your trip? Here’s the short answer: pack like someone who’s seen a few things go sideways. Cover your bases for anything from a sprain to a serious emergency far from home.

First, don’t leave without a solid travel health insurance card or documents that prove you actually bought international coverage. If you bought a Medicare supplemental plan (like Medigap or a Medicare Advantage policy) that specifically says it covers emergencies abroad, print the confirmation and stick it with your travel documents. Local hospitals or clinics often want proof of coverage before treating you—or they’ll expect cash up front.

You should also bring:

- Travel insurance card with your policy number and 24/7 helpline—snap a photo and keep a paper copy.

- List of medications you use (generic names too, not just brand names).

- Doctor’s contact info and details of your conditions or allergies.

- Copies of essential prescriptions, in case you need a refill overseas.

- Emergency contacts (family and a friend at home).

- Any key medical documents, like a summary from your doctor if you have a chronic condition, translated if possible.

- Passport and copies of identification—sometimes a hospital will want this up front if you’re admitted.

The CDC recommends travelers with serious health conditions pack enough medication for the whole trip plus a few extra days—supply chain snags happen. And always keep medications in your carry-on, not checked baggage.

A quick peek at real numbers: according to the US State Department, a medical evacuation from another country can cost anywhere from $10,000 to over $100,000. Travel insurance is not just a bureaucratic step—it can keep your savings from getting torched by one unlucky accident abroad.

| Item | Why You Need It |

|---|---|

| Travel insurance card | Proof of coverage for emergencies |

| List of medications | Easy fills, avoids mix-ups abroad |

| Doctor/contact info | Hospital can reach your doctor fast |

| Emergency contacts | Quick help if you can’t speak for yourself |

| Passport/copies | Needed for hospital admittance |

One last tip—don’t keep everything in one bag. Split up your key documents between your carry-on and wallet, and give your travel partner a copy. Backup matters when Murphy’s Law crashes your vacation.